About GST Registration in India

GST registration refers to the mandatory process of enrolling a business under the Goods and Services Tax (GST) regime in India. Under GST, businesses involved in the supply of goods or services with an aggregate turnover exceeding specified thresholds must register with the GST authorities. Upon registration, businesses are issued a unique GST identification number (GSTIN) which is used for compliance, tax filing, and claiming input tax credit. GST registration facilitates legal recognition, enables seamless tax compliance, and ensures participation in the unified indirect tax system aimed at simplifying taxation and promoting transparency in the economy.

Procedure for GST Registration

- Online Application: Visit the GST portal and complete the GST registration application form (GST REG-01) with accurate details regarding business activities, turnover, and other relevant information.

- Verification: After submission, the application undergoes verification by the GST authorities, including scrutiny of submitted documents and information.

- ARN Generation: Upon successful submission, an Application Reference Number (ARN) is generated and communicated to the applicant via email or SMS.

- Submission of Documents: Upload supporting documents such as proof of identity, address, business constitution, bank account details, and authorization forms as per the specified requirements.

- Additional Information: Respond promptly to any queries or requests for additional information from the GST authorities during the verification process.

- Approval: Once the application and documents are verified, and all requirements are met, the GST registration certificate (GST REG-06) is issued electronically.

- GSTIN Allocation: The applicant receives a unique Goods and Services Tax Identification Number (GSTIN) upon successful registration, which is used for tax compliance and reporting.

- Display of Registration Certificate: Display the GST registration certificate at the principal place of business as per GST regulations.

- Compliance: Ensure compliance with GST regulations, including timely filing of returns and payment of taxes as applicable.

Other Registration

Serving to empower, the next step towards ownership.

Key Features & Benefits

Don’t deliver a product, deliver an experience through business registration

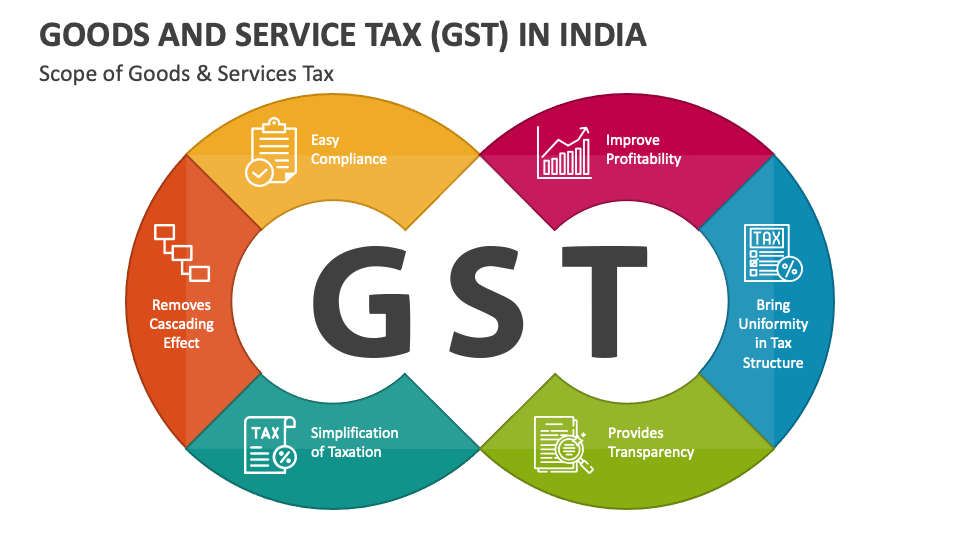

Simplifying Business Operations with GST

Under the Goods and Services Tax (GST) framework, both goods and services are subject to taxation through Central GST (CGST) and State GST (SGST). Additionally, interstate trade incurs Integrated GST (IGST), collected by the Central government and distributed to the respective states. This system fosters a seamless national market, reducing compliance burdens for businesses. Zero-rated exports and unrestricted movement of goods and services further benefit industries, particularly retail and trade sectors, by facilitating smoother operations and enhancing competitiveness in the market. Overall, GST streamlines tax administration and promotes a more business-friendly environment, supporting economic growth and development.

Standardizing Procedures under GST

Under the Goods and Services Tax (GST) regime, there is a standardized approach to procedures such as tax refund and taxpayer registration. Additionally, uniform formats for tax returns contribute to consistency across the taxation system. The tax base is also standardized, as well as the categorization of products or services, along with set timelines for each activity. These measures ensure greater predictability and certainty within the taxation framework. By streamlining procedures and establishing common practices, GST promotes efficiency and transparency, facilitating smoother operations for businesses and enhancing compliance with tax regulations.

Eliminating Cascading Tax Impact with GST

A key advantage of implementing GST is the elimination of cascading tax effects, commonly known as “tax on tax”. In the current tax system, service tax paid on input services cannot be offset against output VAT, leading to an inflated tax burden. However, under GST, businesses can seamlessly avail input tax credit across goods and services, effectively reducing the tax burden on end-users. This systematic approach ensures that taxes are levied only on the value added at each stage of production or distribution, thus removing the cascading effect and promoting fairer taxation practices.

Simplifying Taxation for Small Taxpayers: The Composition Scheme

The Composition Scheme, a user-friendly option under GST, offers relief to small taxpayers by streamlining GST procedures. Eligible businesses can bypass complex formalities and instead pay GST at a predetermined rate based on their turnover. Typically, this scheme is available to taxpayers with a turnover below Rs. 1.5 crore. By opting for the Composition Scheme, businesses can alleviate the burden of compliance and focus on their operations, thus promoting ease of doing business and facilitating growth for small enterprises in the GST regime.

Streamlining GST Processes with a Unified Portal

To facilitate seamless compliance with GST regulations, taxpayers will have access to a unified online platform known as the Goods and Services Tax Network (GSTN). This common portal serves as a one-stop destination for various GST-related activities, including registration, tax filing, and other processes. Leveraging technology extensively, the GSTN simplifies procedures by offering user-friendly interfaces and standardized processes for taxpayers across different sectors. Through the GSTN portal, businesses can efficiently navigate through registration procedures and fulfill their tax obligations online, ensuring greater convenience, transparency, and compliance in the GST ecosystem.

Package

Process of GST Registration

Done with business registration? Next stop, GST registration for business expansion!

01

Initiating GST Registration on the Portal

Begin the process of registering for GST by navigating to the GST portal and selecting the “New Registration” option. Fill out the registration form meticulously, providing all requested details accurately. Take care to complete each field carefully to ensure the information entered is correct. Additionally, enter the captcha provided to verify your identity and prevent automated submissions. Once all required details are filled in, proceed by clicking the “Proceed” button. It is important to review the entered information thoroughly before advancing to the next step to avoid any potential errors or delays in the registration process.

02

Obtain Temporary Reference Number (TRN) through OTP Verification

Initiate the process of obtaining a Temporary Reference Number (TRN) by verifying your identity through OTP authentication. After successfully completing the OTP verification, you will receive a TRN, which serves as a unique identifier for your GST application. Proceed to complete the GST application by entering the generated TRN into the designated field. Ensure all required information is accurately provided and review the application thoroughly before submission. The TRN simplifies the application process by allowing you to resume your application at any time and track its status effectively.

03

Accessing GST Application with TRN and Uploading Documents

Login to your GST application using the Temporary Reference Number (TRN) and proceed to fill out the application form according to the specified requirements. Ensure all necessary information is provided accurately and comprehensively. Additionally, upload the required documents, such as the electricity bill for the registered office address, and any other supporting documents as specified. This step ensures that the application is complete and meets the necessary documentation requirements. By diligently following these procedures, you facilitate the processing of your GST application and ensure compliance with regulatory standards.

04

Finalize Application Submission with DSC or EVC to Generate ARN

Upon uploading all required documents, proceed to formally submit your application by utilizing either a Digital Signature Certificate (DSC) or Electronic Verification Code (EVC). This step serves to authenticate the application’s accuracy and compliance with GST regulations. Following submission, the system generates an Application Reference Number (ARN), which uniquely identifies your application. The ARN is crucial for tracking the progress of your GST registration process and acts as confirmation of successful submission. By completing this process, you conclude the application submission phase and initiate the subsequent steps in the GST registration process.

05

Tracking Application Progress and Departmental Approval

Following the generation of the Application Reference Number (ARN), applicants can monitor the status of their application directly on the GST portal. Upon review, the department reserves the authority to approve the GST registration and provide login credentials via the registered email address. In the event of any discrepancies or incomplete information in the application, GST officers may raise queries, prompting applicants to respond within the stipulated timeframe. This interactive process ensures thorough verification and adherence to regulatory standards, facilitating smooth progress in the GST registration process.

Documents Required For GST Registration

Common mistake! entrepreneur pays less attention to minor details

Title of business (Trade name)

Main object details

Board resolution or authorization letter

COI/MOA/AOA in company case, partnership agreement in case of partnership or LLP as applicable

Bank account details

The copy of pan card

Self –attested copy of identity proof (voter card, passport, driving license)

Self-attested copy of address proof (bank statement, mobile bill, telephone bill, electricity bill not older than 2 months)

Photograph of all subscribers and directors

Email & mobile number

Digital signature

Utility bill for registered office address of the company, such as electricity bill/property tax bill/ telephone bill/mobile bill/gas bill etc.

For rented property ( rent agreement )

Request A Quote

SCHEDULE YOUR INITIAL CONSULTATION TODAY

FAQ's

An entrepreneur needs to know what they need and why they need

What is the Goods and Services Tax (GST)?

The Goods and Services Tax (GST) is a consumption-based tax imposed on goods and services. It applies at each stage of the supply chain, from manufacturing to final consumption by the end consumer. Registered dealers are entitled to claim input tax credits for taxes paid at preceding stages, allowing for offsetting of tax liabilities. Consequently, only the incremental cost incurred in the product is subject to taxation, with the ultimate burden borne by the final consumer. This system ensures fair taxation and minimizes cascading tax effects throughout the production and distribution process.

What are the benefits of registering for GST?

Registering under the Goods and Services Tax (GST) regime offers several advantages to businesses. Firstly, it grants legal recognition as a supplier of goods or services, enhancing credibility and facilitating participation in the formal economy. Additionally, GST registration helps mitigate the risk of double taxation, ensuring that taxes are levied only once on the supply chain. By availing input tax credits and adhering to regulatory requirements, businesses can streamline their operations, enhance competitiveness, and contribute to a more transparent and efficient tax system.

Is it possible for an individual to claim input tax credit without GST registration?

No, an individual cannot claim input tax credit until their business is officially registered under the Goods and Services Tax (GST) system. Only businesses with a valid GSTIN (GST Identification Number) are eligible to avail credit for GST paid on purchases or charge taxes on supplied goods or services. This requirement ensures that tax credits are claimed and utilized within the regulated framework, promoting compliance and transparency in the GST regime.

Is GST registration certificate considered permanent for a business?

Yes, once a business obtains its registration certificate from the GST department, it is considered permanent unless it is voluntarily surrendered, cancelled, deferred, or withdrawn by the authorities. This registration certificate serves as conclusive evidence of the business’s compliance with GST regulations and its eligibility to engage in taxable transactions. As long as the business continues to meet its obligations and remains in compliance with GST laws, the registration certificate remains valid and in effect, providing legal recognition for the business’s operations under the GST regime.

Is it possible to cancel a GST registration certificate?

Yes, GST registration can be cancelled either by the registered taxable person themselves or by their legal representative in the event of the person’s death. Additionally, the tax department reserves the authority to cancel registration if returns are not filed correctly or for other valid reasons. This cancellation process ensures that only compliant businesses remain registered under the GST regime, promoting accountability and maintaining the integrity of the tax system.

Is a private limited company suitable for making FDI in india?

Yes, perfectly suitable. The private limited have been an immensely prevalent form of business entity among foreign investors for creating the direct foreign investment in any country (subject to FDI guidelines).

Why we are Best?

We give best, Because you deserve best.

Client's Reviews

The educational prerequisites for becoming a lawyer vary greatly from country to country. Law is taught by a faculty of law, which is a university's general

“Startway Business Solutions made registering my company a breeze! Professional, efficient, and reliable. Highly recommended!”

Thanks to Mr. Dheeraj who co-ordinate with me very nicely😊”

“Startway Business Solution Provides good Services in affordable prices & the staff of Startway is very responsible and dedicated to work so we get smooth and timely work in friendly environment.

They give there 💯% on Assignment they are getting.”